After one of the sharpest market drops in history, it’s only natural to feel uneasy right now.

Over the past two weeks, investors have been navigating sharp swings in global markets, triggered by major tariff announcements, rising interest rates, and ongoing economic uncertainty. With headlines moving fast, it’s worth stepping back to understand what’s really happening and what it means for your long-term strategy.

Let’s recap what’s driving volatility.

It started with a sweeping new trade policy: a 10% blanket tariff on all imports, along with higher tariff rates on many countries, announced by President Donald Trump.1 The reaction was swift and severe, global markets lost trillions in value, and U.S. stocks experienced a dramatic drop, with the Dow falling more than 4,000 points in just two days.

Markets briefly rebounded after a temporary pause on some tariffs was announced, but the relief didn’t last. Retaliatory tariffs from China and renewed threats of further trade restrictions reignited uncertainty, leaving investors on edge heading into mid-April.

And it wasn’t just the stock market reacting. In an unusual twist, the bond market moved sharply too, just not in the direction many expected.

Typically, during market turmoil, investors flock to U.S. Treasuries for safety, causing yields to fall. But this time, the opposite happened. Over the past week, the yield on the 10-year Treasury surged at its fastest pace since 2001.2

What’s different? Many investors are growing concerned that unpredictable tariff policies are eroding confidence in the U.S. economy. Instead of turning to Treasuries, some are shifting capital to other safe havens, like the Swiss franc or gold. That pullback in demand has driven Treasury prices down and yields up.

This unusual pattern is a sign of just how much uncertainty the current policy environment has introduced. But again, it doesn’t necessarily point to a long-term problem, it’s a reflection of short-term anxiety.

But what does all of this mean for your portfolio?

It’s normal to feel unsettled by swings like these. But short-term volatility doesn’t mean your long-term plan is off-course.

Think of market volatility as turbulence on a flight. It’s uncomfortable and can feel unpredictable, but it doesn’t mean the pilot (or your plan) has lost control. In most cases, the best move is to stay buckled in and avoid sudden changes.

If you need proof that staying buckled in works, just take a look at the historical data.

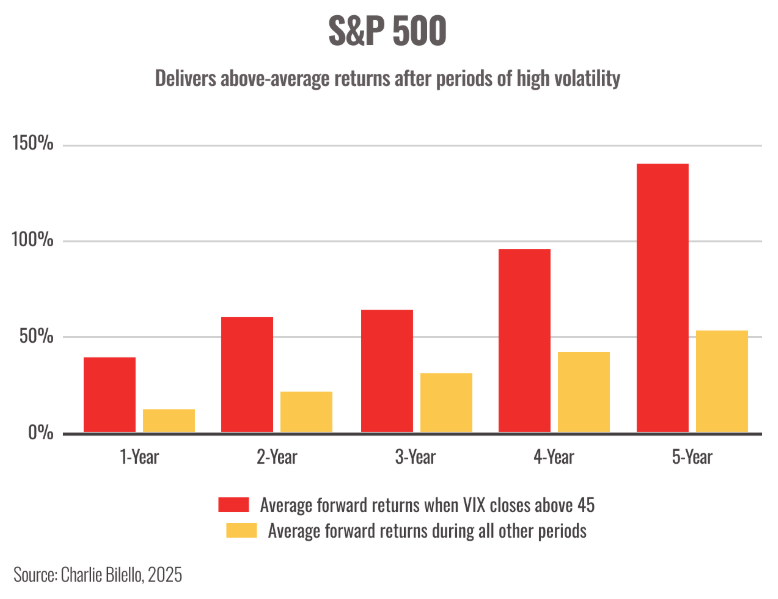

One signal investors often watch during times like these is the VIX, often called Wall Street’s “fear gauge.” It measures how much market movement investors expect in the short term and tends to spike when uncertainty is at its peak.

Last week, the VIX surged 109%, marking the third-largest weekly increase in history.3 While that may sound alarming, history tells a more hopeful story. After past spikes of this size, the stock market has typically delivered above-average returns over the next 1, 3, and 5 years.3

In fact, as you can see in the chart below, after the highest weekly VIX levels on record, the market has rebounded over the following five years, with returns well above historical averages.

That said, no one knows exactly what’s coming next.

Past performance does not guarantee future results, and while strong returns have sometimes followed past VIX spikes, outcomes can vary and are not guaranteed.

Markets could remain rocky. New policy decisions, economic data, or global developments may push prices lower before things stabilize. Or we could see a quicker rebound than many expect.

Either outcome is possible, and that’s precisely why disciplined, long-term investing matters.

The point isn’t to guess the next move. It’s to make sure you’re positioned for the full journey, including both the downturns and the recoveries.

Let’s focus on what we can control:

- How we react. Staying calm and avoiding emotional decisions can make a world of difference.

- How we stay diversified. Broad exposure helps reduce reliance on any single market outcome.

- How we manage risk. Your plan was built with volatility in mind—this is part of the process, not a failure of it.

Importantly, these tariff discussions are still developing. There’s a lot we don’t know yet—and markets don’t like uncertainty. But even amid all the turbulence, there are silver linings. Just six days after that brutal drop, markets saw one of their biggest one-day gains in history. Defensive sectors like consumer staples have also held up relatively well, which only reinforces the importance of diversification.

We don’t try to predict the future—we prepare for it.

If you’re feeling unsure, you’re not alone.

But it’s during uncertain moments like this that long-term discipline matters most. Market swings are a natural part of investing, and reacting emotionally to short-term headlines can often do more harm than good.

If you'd like to talk through what this means for your plan, I’m just a call away. Let’s make sure you feel confident about where things stand.

Please give us a call at (208) 795-5123 or schedule a meeting with this link.

Sean West, Wealth Management Advisor/ CFP®

Sources:

1. AP News, 2025 [URL: https://apnews.com/article/trump-tariffs-pause-businesses-reaction-a61a1adcaf6332f6188ae1d70664b898]

2. Bloomberg, 2025 [URL: https://www.bloomberg.com/news/articles/2025-04-11/us-treasury-selloff-is-worst-since-repo-market-chaos-in-2019]

3. Charlie Bilello Blog, 2025 [URL: https://bilello.blog/2025/the-week-in-charts-4-6-25]

Chart Source: Charlie Bilello, 2025 [URL: https://bilello.blog/2025/the-week-in-charts-4-6-25]

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.