Table of Contents

Introduction

Capital gains tax can be a confusing and costly issue for most Americans. It is easy to misunderstand your full tax liability and a lot of us over or under pay your taxes. Knowing the ins and outs of dealing with capital gains can save you time and money.

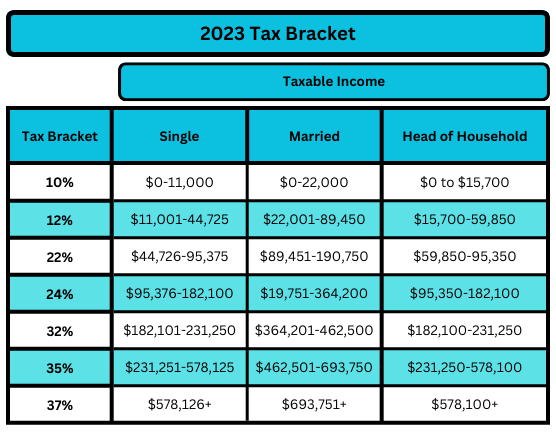

How Tax Brackets Work

Before you learn how capital gains taxes work you must understand how tax brackets work. Income tax is based on your taxable income and goes up as your income rises. Each bracket applies a percentage to the piece of your income that falls in it. For example, single individuals pay 10% on the first 11,000 dollars they earn. That means they owe 1,100 dollars for income tax on that 11,000 (10% x $11,000 = $1,100). If they had made $11,500 dollars they would have owed the 1,100 and then 12% on the 500 because they entered into the next tax bracket. Overall, the single taxpayer would owe $1,100 + (12% x 500) = $1,160.

Want to learn more about tax brackets? Click Here

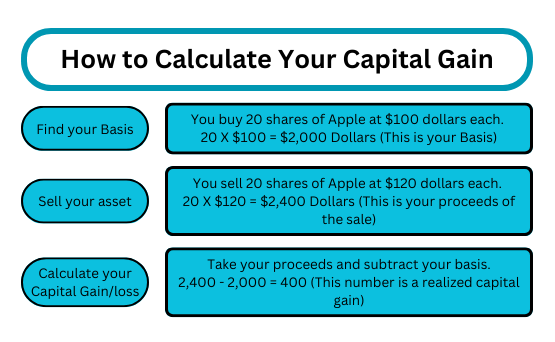

How to Calculate Your Capital Gain or Loss

To calculate your gain or loss you need to know your basis. Basis is the amount you originally paid for your asset. Simply subtract your basis from your sale price and that number is your capital gain or loss.

For example, if you were to buy 20 shares of Apple for 100 each your basis is 2000 dollars (100 x 20 = 2000). If you then sold your 20 shares for 120 each, you would take your proceeds 20 x 120 = 2,400 and subtract your basis of 2000. This would leave you with a 400 dollar gain to pay taxes on.

How Capital Gains Taxes Work

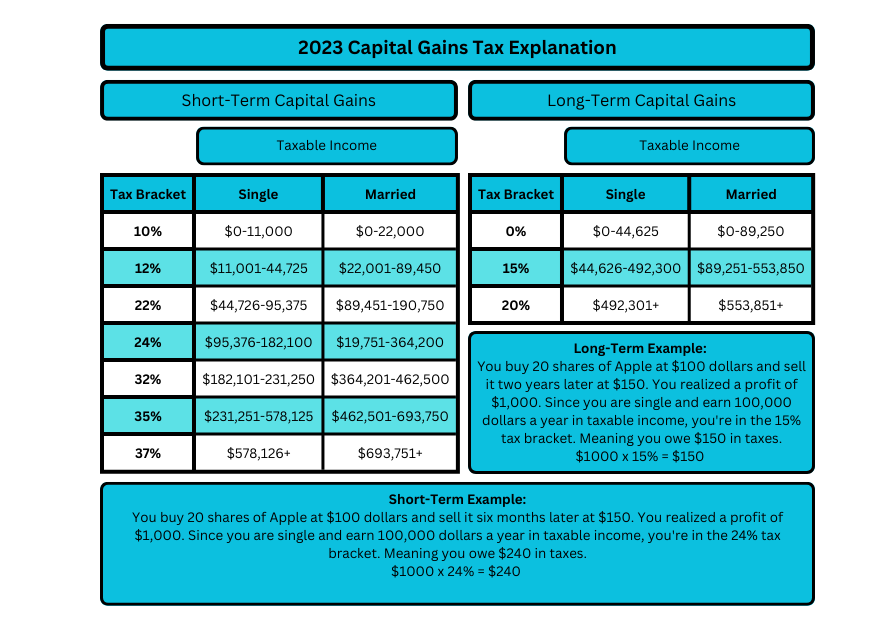

Anytime you sell an asset for a profit the IRS expects you to pay them taxes on the gain. This is known as capital gains tax. There are two types of capital gains tax, long-term and short-term. Long term capital gains apply to assets you have held for 1 year or longer, while short term capital gains apply to assets held for under a year.

Short-term capital gains are taxed at your highest tax bracket, also known as your marginal tax rate. This is the highest capital gain tax you can incur. Moreover, long-term capital gains operate differently with their own tax bracket that is based on your income.

Realized Vs. Unrealized Capital Gains

You might have read somewhere on an account statement "Unrealized Gain" or "Unrealized Loss." This means you still have that asset. Once you sell the asset then the statement would say realized gain or loss. The IRS only taxes gains that you have realized, ignoring your unrealized gains.

Writing Off Realized Capital Losses

While the IRS does take a portion of your capital gains, they also let you write off your losses. Say you were forced to sell an asset at a low then you can reduce your taxable income by that amount up to 3,000 dollars a year. Furthermore, if that loss is greater than 3000 you can carry that loss over and write off more of it the next year.

Carry Forward Loss Can Offset Your Capital Gain

Imagine you have a large loss one year and can only write off 3000 dollars on your taxes. Now you have to continuously write off 3000 dollars a year. Well, if you end up having a large capital gain you can use the previous year's loss to offset that gain.

Imagine you lost 50,000 dollars in one year. You wrote off 3,000 dollars of it and now you have 47,000 dollars sitting around. That 47,000 is known as a "Carry Forward Loss." If next year you had a capital gain of 27,000 you could use the 47,000 in carry forward loss to off set it. Simply take the loss and subtract the gain, 47,000 - 27,000 = 20,000. This way you don't have to pay capital gains tax on the 27,000. You also get to write off the 3000 more of the loss on your current tax return.

Strategies For Dealing with Capital Gains

Interested in finding out what strategy would work best for you? Contact us for a free consultation.

Using Tax Deferred Accounts and Capital Gains

When you use retirement accounts like 401(k)s or IRAs the IRS says that you don't need to pay capital gains taxes when you buy and sell within that account. Unfortunately, you will pay income tax on distributions from pre-tax accounts at a later date. That's why these accounts are known as tax deferred accounts; you are deferring taxes to a later date. This strategy is best for people who don't need their funds until retirement.

For more information on how different retirement accounts work click here.

1031 Exchanges and Deferring Capital Gains

1031 Exchanges, also known as "Like-Kind Exchanges," work by deferring your capital gains tax. Instead of realizing a gain by selling your investment property, you simply exchange your old property for a new one. That said, it is important to know how the process works and the different avenues you can take when completing an exchange. Learn more about 1031 Exchanges here.

Tax Favored Investments That Avoid Capital Gains

Mutual funds create what are known as "Phantom Taxes." This is when a mutual fund pays a capital gain at the end of the year even though you didn't sell any of the fund. However, there are certain funds that take into account capital gains when buying and selling securities. These are known as tax-managed funds. Furthermore, exchange traded funds (ETF)s also do a great job at minimizing capital gains flowing through to investors. For long-term investments that are in a non-qualified account this is a great option.

How You File Your Taxes Can Affect Your Overall Capital Gains Tax

Depending on how you file your taxes, you might be able to save money on your capital gains tax. For instance, heads of household can make more and be in a lower tax bracket. That said not everyone can qualify for head of household status. If you want to research the best way for you to file your taxes, click here.

Gift Assets to Children or Grandchildren

If you gift an asset to your child or grandchild, they might be in a lower tax bracket and thus owe less in capital gains tax. That said if your child is a minor or isn't 24 and is in college, they could be subject to the "kiddie tax." This tax rate stipulates that any income the child earns past 2,500 dollars is taxed at the parents' marginal rate. Furthermore, any amount between 1,250 and 2,500 is taxed at the child's tax rate.

Using Donor Advised Funds to Avoid Capital Gains Taxes

A donor advised fund is an account that you have ear marked for charitable giving. If you know you want to give to charity each year, you might consider placing funds in the account then investing those dollars to give away later. This way you don't pay capital gains taxes on funds you were going to donate anyway.

Donations In Kind

If you give to charity you might also consider donating in kind. This means you donate an asset outright to a charity, this could be stock, land, or any other type of asset. Since, you are donating the whole asset you don't have to pay a capital gain tax.

Seven Things to Remember About Capital Gains

- You can write off a capital loss to offset your capital gains.

- How you file your taxes can affect your capital gains tax paid.

- If you are dealing with a capital gain tax from a rental property you might consider a 1031 Exchange.

- Certain investment funds manage capital gains and avoid a capital gain tax form flowing through to the investor.

- If you donate your money, you should consider using a donor advised fund.

- Long-term capital gains cost less than short term gains. Hold your assets for 1 year if possible.

- Paying taxes isn't fun, but at least you made money. Sometimes there is no way to get out of paying capital gains taxes.

Conclusion

Capital gains are taxed depending on your taxable income. If you can reduce your taxable income and fall into a lower tax bracket by contributing to IRA's or by using other strategies you should. Furthermore, you should know the difference between unrealized and realized capital gains. You should never pay taxes on unrealized gains.

Capital gains taxes seem like they are complicated on the surface, but hopefully this article has cleared things up for you. If you still don't know feel comfortable with how capital gains work feel free to contact us.

Sean West, Wealth Management Advisor/ CFP®

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.

Resources

IRS:

https://www.irs.gov/taxtopics/tc409