How high-income individuals can optimize their deductions by strategically timing charitable contributions.

Beyond the gratification that comes from supporting worthy causes and enriching society, charitable giving provides tax benefits for donors. Through a specific itemization strategy called bunching, taxpayers can reduce their taxable income. This blog post provides a brief overview of deductions in taxation, dissects bunching, and elaborates additional strategies to maximize deductions.

Table of Contents

Deductions

Deductions are a sum determined by the government that can be removed from an individual’s taxable income. Deductions exist to ease the tax burden on individuals whose income may be distributed to expenditures that the government seeks to promote, such as interest, medical and dental expenses, and charitable gifts.

Taxpayers can choose between taking either the standard or itemized deduction every year:

- Standard Deduction: A fixed deduction amount set annually by the IRS based on filing status. For example, in 2025, a single taxpayer has a standard deduction of $15,000.

- Itemized Deduction: Individual deductions depending on the financial and other circumstances of the individual.

Common Itemized Deductions

Following the line items on a Schedule A Form 1040, itemizing includes:

- Medical and Dental Expenses: Medical expenses may be itemized given that expenses exceed 7.5% of the adjusted gross income and the expenses have not been reimbursed or paid by others.

- Taxes Paid: Refers to state and local taxes, with a cap of $10,000 for individuals and married couples.

- Interest Paid: Interest on both mortgages and investments are also considered when itemizing.

- Gifts to Charity: Charitable donations, given by cash, check, or other forms are also an itemizable deduction.

Additional deductions exist for freelance workers, business owners, and individuals with special circumstances.

Individuals should seek to take the deduction—whether it be standard or itemized—that reduces the amount of taxable income they have to the largest degree, thus reducing their tax burden. In 2018, the Tax Cuts and Jobs Act raised the standard deduction, making benefits from itemizing less accessible. However, there are still strategies that can be used to reduce taxes through itemization such as bunching.

What is Bunching?

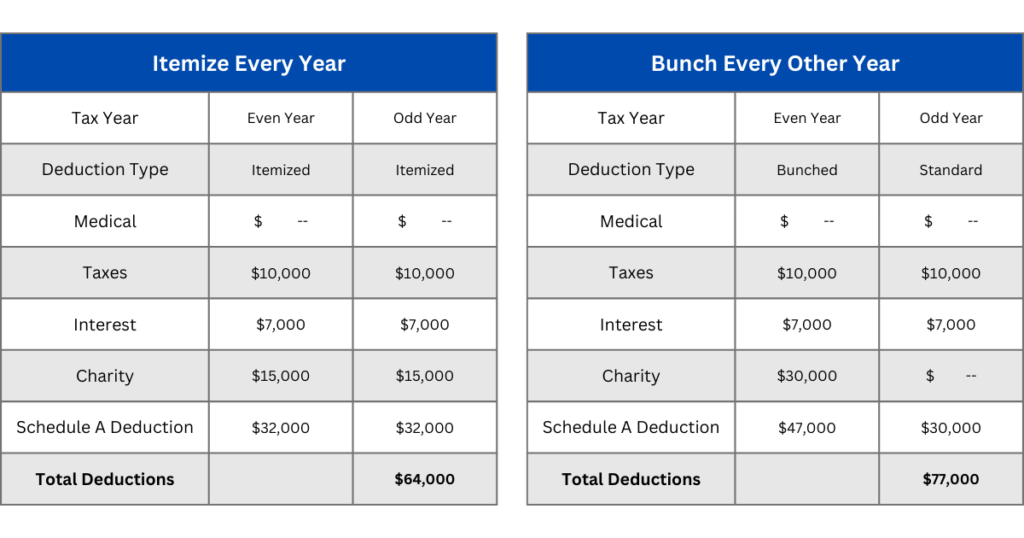

Bunching is a tax strategy used to optimize tax returns over a two-year period, specifically by itemizing every other year. When individuals bunch, their charitable gifts for two years are given in the same year, generally making an itemized deduction more favorable. The graph below provides a visual representation of the effects of bunching for a couple whose standard deduction would be $30,000:

As illustrated, itemizing every year can be strategic when itemized deductions exceed standard deductions. However, when bunching charitable contributions from two years, the standard deduction exceeded the potential itemized deduction of the odd year ($17,000). This led to an additional $13,000 of tax-free income over two years, saving the couple up to thousands of dollars depending on their current tax bracket.

Who Should Consider Bunching?

Although bunching can provide large tax breaks for many individuals, some circumstances are better for bunching. Individuals in these categories have the greatest advantage through bunching:

- Taxpayers close to the standard deduction threshold ($15,000 Single or $30,000 Married in 2025).

- Those with flexibility in charitable giving schedules.

- High-income earners seeking to manage tax liability.

- Individuals nearing retirement who want to front-load charitable giving before taking RMDs.

- Households with fluctuating incomes that may benefit from strategic donation timing.

Donation Strategies to Enhance Bunching

Implementing the right donation strategies can make bunching even more effective, maximizing tax savings while ensuring charitable giving remains consistent. Here are three key approaches:

Donor-Advised Funds (DAFs):

A Donor-Advised Fund (DAF) allows individuals to bunch multiple years’ worth of charitable contributions into a single tax year, securing a large deduction upfront while distributing donations over time. After contributing to a DAF, the funds can be invested and grow tax-free, giving donors flexibility in when and how they support charities. This strategy is particularly useful for those who want to exceed the standard deduction threshold in high-income years while maintaining steady charitable giving. Once contributed into a DAF, the funds cannot be withdrawn for personal use, although they may be invested or given at any time following the donor’s discretion.

Donations in Kind:

Instead of donating cash, individuals can contribute appreciated assets such as stocks, mutual funds, or real estate directly to a charity or a DAF. This approach offers two tax benefits: (1) the donor avoids capital gains tax on the asset’s appreciation, and (2) they receive a charitable deduction for the full fair market value of the asset. By leveraging donations in kind, taxpayers can reduce their tax burden more efficiently than by donating cash alone. However, not all charities receive non-cash assets as donations.

Qualified Charitable Distributions (QCDs):

For retirees aged 70½ and older, Qualified Charitable Distributions (QCDs) provide a tax-efficient way to give. A QCD allows an individual to donate up to $100,000 per year directly from a Traditional IRA to a qualified charity. Unlike regular withdrawals, QCDs are excluded from taxable income, making them especially useful for those subject to Required Minimum Distributions (RMDs). Since QCDs don’t require itemizing deductions, they offer a way to achieve tax savings even when taking the standard deduction.

By combining these strategies with bunching, taxpayers can optimize their charitable giving while making the most of available tax benefits. Click here to read more about each of these strategies.

Personalized Tax Planning

Bunching charitable contributions is a powerful tax strategy that allows taxpayers to maximize deductions while maintaining their giving goals. By strategically timing donations and leveraging tools like Donor-Advised Funds (DAFs), donations in kind, and Qualified Charitable Distributions (QCDs), individuals can optimize their tax savings and support the causes they care about.

Interested in how much money you could save on taxes through bunching? Start tax planning today with White Cloud Wealth Management. As fiduciaries, we prioritize your best interests, offering comprehensive financial planning designed to inspire confidence in your financial future. We can analyze your unique situation and help you to use the best tax strategies available to you.

Whether you prefer an in-person meeting or a remote consultation, we’d be delighted to discuss your goals and answer any questions you have.

Click to schedule your personalized consultation.

By Jacob Nye, Wealth Management Advisor

FAQs: Bunching and Charitable Giving

1. What is bunching, and why does it help with taxes?

Bunching is a tax strategy that involves consolidating multiple years’ worth of charitable donations into a single tax year to exceed the standard deduction and allow for itemizing. This helps maximize tax savings in high-donation years while taking the standard deduction in other years.

2. Who benefits most from bunching charitable donations?

Bunching is most beneficial for individuals or families whose total itemizable deductions (including charitable contributions, mortgage interest, and state/local taxes) are close to or just below the standard deduction threshold. It’s especially useful for high-income earners and retirees with flexible giving options.

3. How do Donor-Advised Funds (DAFs) help with bunching?

DAFs allow donors to contribute a large sum in one year (to take advantage of bunching), receive an immediate tax deduction, and then distribute the funds to charities gradually over time. This maintains a consistent giving pattern without sacrificing tax efficiency.

4. Can I bunch donations without using a DAF?

Yes, you can bunch donations by simply making larger-than-normal contributions directly to charities in certain years while skipping or reducing donations in others. However, a DAF provides additional flexibility by allowing you to control the timing of when charities receive the funds.

5. How do donations in kind, like stocks, affect my taxes?

Donating appreciated assets (e.g., stocks or real estate) instead of cash allows you to avoid capital gains tax and claim a deduction for the full fair market value of the asset. This is often more tax-efficient than selling the asset first and donating the cash.

6. What is a Qualified Charitable Distribution (QCD), and how does it work?

A QCD is a direct transfer from an IRA to a charity for individuals aged 70½ or older. It allows you to donate up to $100,000 annually without adding to taxable income, making it a great option for retirees who must take Required Minimum Distributions (RMDs).

7. Can I use QCDs and bunching together?

Not exactly—QCDs do not count as itemized deductions since they’re excluded from taxable income. However, they are still a valuable tax-saving strategy for retirees who no longer itemize but want to make tax-efficient charitable donations.

8. What happens if I donate more than I can deduct in one year?

If your charitable contributions exceed the IRS deduction limits (usually 60% of AGI for cash donations or 30% of AGI for appreciated assets), you can carry forward the excess deduction for up to five future tax years.

9. Does bunching work for small donations, or is it only for large gifts?

Bunching is most effective when the total donations are large enough to exceed the standard deduction, but it can work at different income levels. Even moderate givers can use this strategy by planning their donations in multi-year cycles.

10. How do I decide if bunching is right for me?

To determine if bunching makes sense, compare your expected itemizable deductions to the standard deduction. If your total itemized deductions in a typical year are below the standard deduction, but bunching multiple years’ donations could push you over, then it’s a strategy worth considering. A tax professional can help you calculate the potential benefits.

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.