Table of Contents

Have you ever thought about selling your rental and reinvesting the proceeds in another property? If so, you may be able to avoid paying capital gains taxes on the sale of your original property by completing a 1031 exchange. Named after section 1031 of the US Tax Code, this strategy is commonly used by investors when selling rental properties or other investment properties.

How Does a 1031 Exchange Work?

1031 Exchanges, also known as "Like-Kind Exchanges," work by deferring your capital gains tax. Instead of realizing a gain by selling your investment property, you simply exchange your old property for a new one. That said, it is important to know the how the process works and the different avenues you can take when completing an exchange.

How Capital Gains Taxes Work In 1031 Exchanges

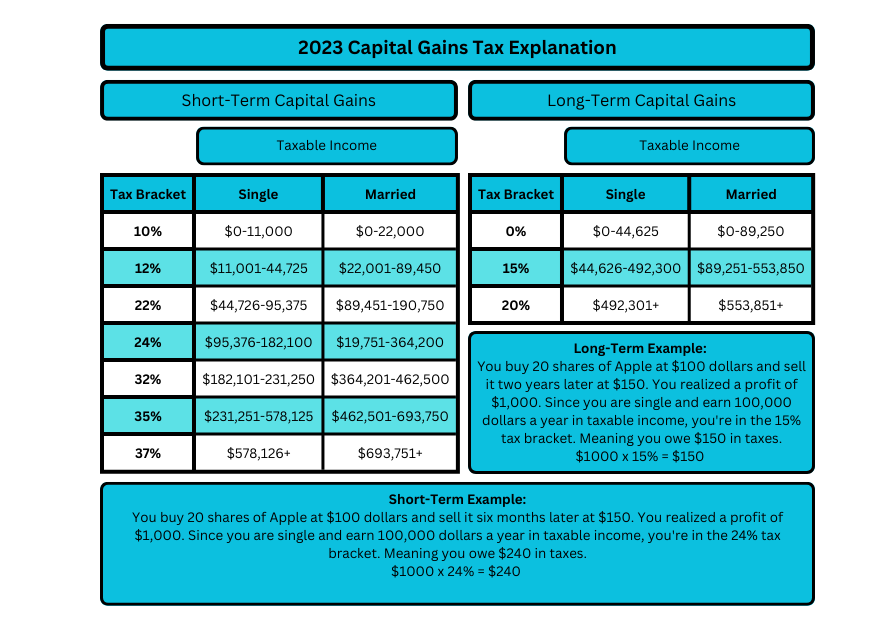

Anytime you sell an asset for a profit the IRS expects you to pay them taxes on the gain. This is known as capital gains tax. There are two types of capital gains tax, long-term and short-term. Long term capital gains apply to assets you have held for 1 year or longer, while short term capital gains apply to assets held for under a year.

The chart below shows how each type of capital gain is taxed and the effect of a 1031 Exchange for a property worth 500,000 dollars that was bought for 400,000. For the purposes of this example let's say the investor's taxable income is 100,000 dollars and they are married.

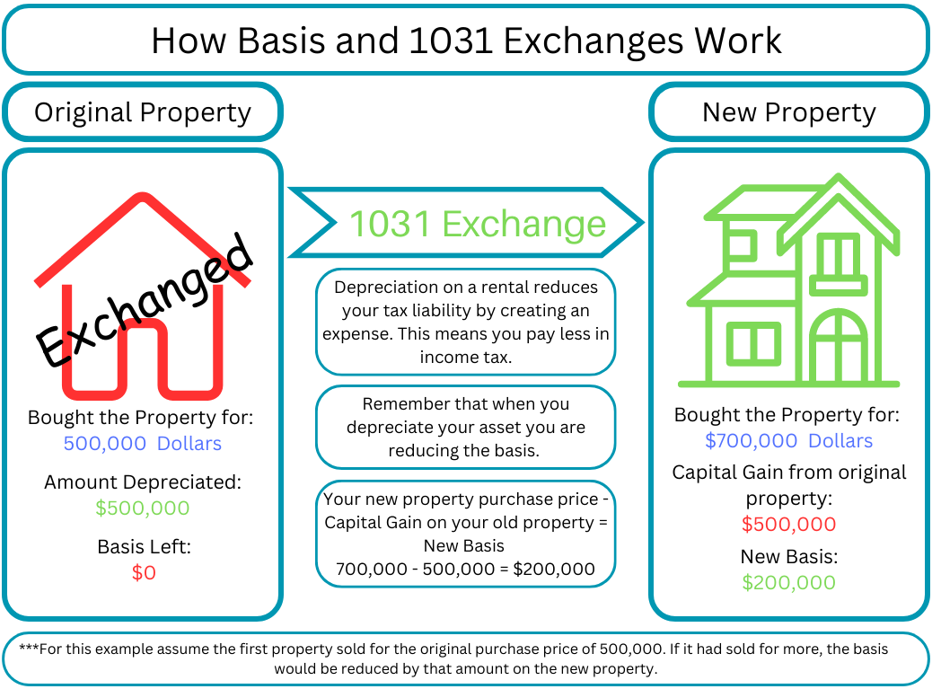

How a 1031 Exchange Effects Your Basis

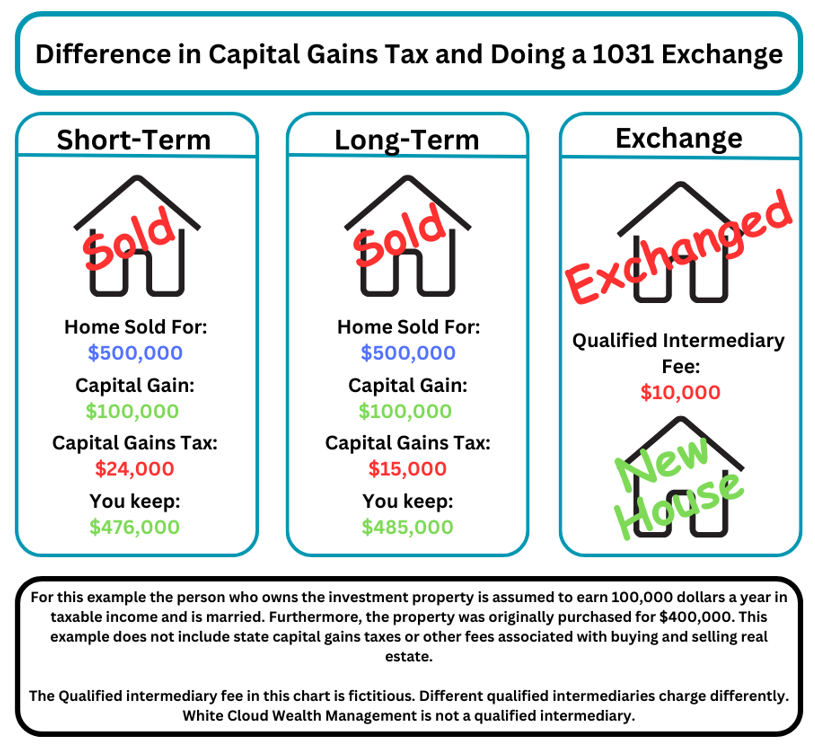

In each case only the gain is taxable, the amount you purchased the asset for (Known as your Basis) is not taxable. Basically, the IRS allows you to transfer your basis from your old property to your new property in a 1031 exchange. It’s important to note that in cases where you depreciated your original property the basis is significantly reduced.

The basis for your new property is calculated by taking your purchase price of the new property and subtracting the gain from your old property. For example, you own a 100,000 dollar rental property and do a 1031 exchange for a 150,000 dollar house. Originally you bought your rental for 70,000 dollars and have an unrealized gain of 30,000 dollars. Since you purchased your new house for 150,000 dollars you simply subtract 30,000 dollars from the purchase price. This makes your basis 120,000 dollars on the new property.

This might all sound relatively straight forward, but it is important to remember that there are a lot of rules and regulations around 1031 Exchanges. If the basis is calculate incorrectly, you could have big problems with your taxes later on. Be sure to find professional help if you don't fully understand the process.

The Big Reason to do a 1031 Exchange: Recapturing Depreciation Expenses

Depreciation is an expense that businesses use to show the diminishing value of their assets over time. This might sound weird because real estate historically goes up in value, but nonetheless your rental property can be completely depreciated over a number of years.

The amount you can depreciate on your rental is the basis (defined in section above). However, every time you write off depreciation on your rental the basis is reduced by that amount. So if your basis is 100,000 dollars and you depreciate 10,000 dollars a year, you will find that you no longer have a depreciation expense left after 10 years.

Since you can exchange your home for one that is up to 200% of the value of your old home, an interesting opportunity rejuvenate your depreciation expense arises. Let's say you own a rental worth 500,000 dollars and you have used up all of the depreciation expenses possible. You can use a 1031 to buy a property worth up to 1,000,000 dollars. Let's say the new property is worth 700,000 dollars for this example though. Once you calculate your basis by subtracting the profit of the old property ($500,000 dollars) you will find that you now have 200,000 dollars to depreciate. View the example below:

Depreciation is the real estate professionals best friend. Without it your profitability is greatly diminished. If you are interested in learning more about depreciation for your rental property click here. (If no link is present the article is being edited and will be available in a few days).

Use a Qualified Intermediary to Avoid Penalties

One very important step in the 1031 Exchange process is to never take control of the funds. Instead any proceeds should be held by a Qualified Intermediary(QI) until the new property is bought. If you take control of the funds from the sale of your first property at anytime the IRS will force you to pay capital gains taxes, defeating the purpose of doing the exchange.

QI's offer their service for a small fee based on the amount your home sells for.

Process Of Completing a 1031 Exchange

Just to recap how the 1031 Exchange process works, here is a quick check list:

- Make sure your property qualifies for a 1031 Exchange. You can view the criteria below or at the IRS website.

- Find a qualified intermediary to hold the funds from the sale of the original property.

- If you are new to 1031 Exchanges consult a professional that has experience completing these types of transactions. This could be your accountant, financial advisor, or lawyer to name a few.

- Sell your investment property and put the funds with the qualified intermediary.

- Identify the next property within 45 days to avoid your 1031 Exchange from being canceled.

- Wait for the qualified intermediary to file all of the correct paperwork to buy your new property. This process should take less than 180 days.

- File your taxes correctly. There is specific paperwork to file with the IRS that signify that you made a 1031 Exchange. Furthermore, you may still owe taxes on any amount that wasn't put into the new property. Contact a CPA that is experienced in this type of transaction.

- Repeat! The awesome thing about 1031 Exchanges is you can do them as much as you'd like. The only exception is that you wait two years if your exchange was for a property owned by a family member ("The Related Party Rule" from below).

1031 Exchange Rules

Qualified Intermediary Rule

You must use a qualified intermediary (QI) when completing a 1031 Exchange. A QI is an entity that facilitates the exchange by holding onto the proceeds from the sale of your property until you have identified a replacement property. The QI then distributes the funds to the seller of the replacement property. QI’s are very important to your 1031 exchange. If you take control of the funds at any point you no longer qualify for the exchange and will owe capital gains tax.

The "Related Party" Rule

A related party exchange happens when an investor does a 1031 exchange with a family member. The IRS defines the relationships in IRC Section 707(b) or 267(b). If you are doing a 1031 Exchange with a family member defined by the IRS in those sections, you must wait two years before you can do another 1031 Exchange with that property.

45 Day Rule

An investor has 45 days to identify the replacement property or properties. If the investor fails to find the investment property by the end of the 45 days, they will be subject to the full amount of capital gains tax applicable.

180 Day Rule

An investor only has 180 days to complete the 1031 exchange. If the new property isn’t purchased by the end of the 180 days, then the investor will need to pay the full capital gains tax.

95% Rule

The 95% rule says that the replacement property needs to be worth at least 95% of the original property. For example, if your property is worth 100,000 dollars, then your replacement property needs to be worth a minimum of 95,000 dollars.

200% Rule

200% rule stipulates that no replacement property or properties can exceed 200% of the original property value. For example, if you exchange a property worth 100,000 then the replacement property value cannot exceed 200,000 dollars.

What Properties Qualify

To be clear 1031 exchanges don’t apply to inventory or stock. In fact, they only work for investment properties. This means that the property needs to be used for productive means. Here are some examples:

- Farm land

- Warehouses or other industrial buildings

- Commercial spaces such as malls or offices

- Vacant Land

- Rental properties including but not limited to apartments, residential housing, and hotels.

That said it is easier to think about what properties don't qualify. You can not do a 1031 exchange for any property used for personal use. This means both the original and second property need to be used for productive means and the owner can't use either property for recreation or residential purposes.

Types of 1031 Exchanges

It is important to note that we are talking about complex transactions, and you should seek professional guidance to ensure that everything is done correctly. I note this here because different types of exchanges have their own challenges and not all aspects of each type are listed in this section.

Delayed 1031 Exchange

A delayed 1031 exchange is the most common exchange used. In order to qualify for this exchange, the new property must be identified within 45 days of selling the old property, and it must be held for at least 180 days. There is also a 95% rule, which stipulates that at least 95% of the proceeds from the sale must be used to purchase the new property. In addition, a qualified intermediary must be used in order to facilitate the exchange. If all of these requirements are met, then the IRS will allow the exchange and defer the capital gains tax.

Simultaneous 1031 Exchange

In a simultaneous 1031 exchange, the sale of the old property and the purchase of the new property occur on the same day. This type of exchange is sometimes referred to as a "same-day" 1031 exchange. To qualify for this treatment, the taxpayer must have already identified the new property prior to closing on the sale of the old property. Therefore, the Simultaneous exchange is often used when the taxpayer already has their eye on a replacement property and wants to move quickly to avoid paying fees to a qualified intermediary. This is the most difficult exchange to pull off because of the precise timing involved.

A Reverse 1031 Exchange

A reverse exchange, also known as an exchange in reverse, is when an investor purchases the replacement property before selling the original property. The qualified intermediary holds the title to the new property during the transaction to ensure that the taxpayer does not have constructive receipt of the funds. While a reverse 1031 can be beneficial for taxpayers who need to act quickly to take advantage of a 1031 exchange, it can also be more expensive and complex than a regular 1031 exchange. As with any tax-related transaction, it's important to consult with a qualified tax advisor to determine if a reverse 1031 exchange is right for you.

An Improvement 1031 Exchange

Improvement exchanges are 1031 exchanges where the replacement property is improved before the 180 day deadline is up. This comes in handy if the replacement property value doesn’t meet the 95% rule, meaning it doesn’t qualify as a like-kind investment. This exchange allows investors to claim that their improvements to the replacement property enhance the value and make that property fitting of the like-kind investment rule. This allows the investor to use tax deferred dollars held by the Qualified Intermediary to fix the new property.

All that said it is important to remember that the IRS does not count any property replacements that exceed 200% of the value of the old property. For example, if your old property is worth 100,000 dollars and your replacement property is only worth 90,000 dollars, then you need to improve the replacement property by 5,000 dollars. If in making the improvements, you make the new property’s value worth 201,000 dollars then you will no longer qualify for the 1031 exchange. Meaning you will need to pay capital gains taxes.

How to Find a Qualified Intermediary

You cannot act as your own intermediary in a 1031 exchange. Furthermore, anyone acting as an agent on your behalf cannot act as your intermediary. An agent would include your accountant, Financial Advisor, attorney, or anyone else compensated to act on your behalf. However, these people can give you advice on completing your 1031 Exchange and refer you to a trusted qualified intermediary.

Another way to find a qualified intermediary is to simply search Google and get in contact with them. It is important to research your qualified intermediary and do your due diligence. If you are still having a hard time finding one after searching Google we recommend asking your friends or someone you trust if they have ever done a 1031 Exchange and seeing who they recommend using.

Who to Consult Before a 1031 Exchange

When it comes to 1031 exchanges, it's important to consult with a professional who is knowledgeable about the tax implications. The IRS has strict rules about 1031 exchanges, and if you don't follow them correctly, you could end up owing a significant amount of money in taxes. A financial advisor or CPA can help you understand the rules and make sure that you stay in compliance. If you're working with a real estate professional, they should also be familiar with 1031 exchanges and be able to advise you on the best way to proceed. Remember, when it comes to 1031 exchanges, it's always best to consult with a

professional who is acting in your best interest.

Feel free to send us a message by going to our contact us page!

Downsides of a 1031 Exchange

Fees

Not only will you have to pay for your Qualified Intermediary, but you will also run into regular closing costs from the sale of your home. These two fees together sometimes make the idea of a 1031 exchange not worth the trouble. It is important to understand how all of the fees will effect you, there's a chance the process could cost more than the capital gains tax.

Extra headaches

While buying and selling real estate always comes with its own set of challenges, a 1031 exchange just adds another layer of paper work and stress. If you aren't committed to being a real estate investor, its best to just keep things simple. Especially if you aren't chasing the added depreciation we discussed earlier.

Conclusion

Now that you know how 1031 exchanges work, the process of exchanging, what a qualified intermediary is, the different types of exchanges available, and the risks to be aware of, are you interested in moving forward with a 1031 exchange? If so, great! The next step is to reach out to us and schedule an appointment so we can help ensure your property qualifies.

Exchange regulations are always changing so it's important to have someone on your side who knows all the ins and outs and can help make sure your transaction goes as smoothly as possible. We're here to serve you and answer any questions you may have along the way.

Sean West, Wealth Management Advisor/ CFP®

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.

Resources:

IRS Capital Gain Information:

https://www.irs.gov/taxtopics/tc409