Table of Contents

What is a Roth Conversion?

A Roth conversion is a financial maneuver that can be beneficial for tax savings. Essentially, it involves converting money from certain retirement accounts such as Traditional IRAs and 401(k)s into Roth IRAs. This allows the money to grow tax-free since they are already after-tax contributions. By doing this, individuals can pay their taxes now instead of later in retirement when potentially facing a higher income bracket. However, it's important to do the math and consider potential costs associated with conversions before jumping into them since they can have significant impacts on your current year's filing. Below I share reasons to do a conversion and reasons not to.

Overview of Roth Conversion In 2023

Roth conversions are an excellent way to save on taxes in the long run, especially in 2023. For those that have a large part of their income in taxable accounts will stand to benefit significantly from doing such an action. Under current tax laws, tax rates are expected to rise after 2025; thus, if one converts taxable accounts into a Roth IRA now through 2025, they will pay the lower taxes today rather than facing the anticipated hike years down the road.

Furthermore, not only does this move provide financial benefits moving forward but also provides peace of mind for those who worry about future financial issues resulting from higher taxes and other economic catastrophes. Therefore, Roth conversion is a great decision and a wise choice for anyone considering it in 2023 with the expectation of rising tax rates down the road.

Second you can move depressed investments. Converting an IRA to a Roth IRA in 2023 could be a savvy move for those affected by the decreased value of investments in 2022. This strategy provides the added bonus of safeguarding future gains from taxation, which is a great reward after enduring a market downturn. You can move over more shares and your Roth IRA experience the recovery sheltering the gains from taxes. This is an “Air Jordan” from the foul line, slam dunk!

Reasons to Do Roth Conversions

Tactical Opportunities

Roth conversions can be a powerful financial tool when used properly, particularly if you’ve suffered significant business losses or charitable deductions. Let’s say you are serving your church in a foreign land. This is a great time to do bigger Roth conversions. If you invested in your child’s business and it didn’t go as planned, this creates a great opportunity to move money from your IRA to your Roth. While the effect of this kind of strategy may sound complicated, if you follow the rules, it can often be worth your while to get creative with your taxes! Conversions can help leverage your losses in an effective manner and contribute to your retirement goals - sometimes without additional cost.

Lowering Your RMDs

When considering whether or not to make a Roth conversion, keep in mind that current law allows the account holder’s Roth IRA to remain exempt from required minimum distributions (RMDs). This means it can continue growing tax-free and any remaining funds will stay intact. Even after your passing, if you name your spouse as beneficiary of the account they may roll over ownership - avoiding RMD obligations throughout their lifetime too! Then to top it all off your ROTH IRA transfers to your kids tax free too. They have to take the money out of the account over 10 years, but they take it out tax free!

Tax savings!

Paying Roth conversion taxes with funds outside of an IRA can be a great way to keep more money in the market for longer. Paying the conversion tax outside your IRA is a game-changer because you can move more money into an after tax/ tax free account. After all, taxes are inevitable and it's smart to start planning if you expect any windfalls that would bump you into higher tax brackets. Plus, it could be a lifesaver come retirement when those Roth savings start coming in - why pay taxes now when it could potentially add up to much more money saved later? It takes some savvy financial planning, but using funds from other sources could make a world of difference at retirement, tax time, and at death.

Those with liquid assets outside of retirement accounts should always use those funds to pay the conversion tax. For example, let’s assume an investor converted 600,000 from 2023 to 2025 (200,000 per year for three years). The investors target percentage was the 24% marginal tax rate. They would pay 48000 in taxes per year for a total of 144,000.

So, you’d have 144,000 less in a taxable account and 144,000 more in a ROTH account. After ten years both accounts can grow and double in value. In the best-case scenario, you have 1,200,000 in a ROTH instead of 912,000 in a ROTH and 288,000 in a taxable account. You might do the quick math and realize they both equal 1.2 million. However, the taxable account has capital gains of 144,000 which taxed at 20% (the capital gains rate after 2025) is 28,800. You have just under 29,000 less because you chose to pay with IRA money instead of outside funds. Imagine what happens after 20 years?

By using outside funds to pay the taxes due on a Roth conversion, investors can create positive mathematical results and may even be able to avoid 10% early withdrawal penalty for those under age 59½. This savvy maneuver is an ideal way to ensure maximum benefit from tax savings while allowing more money than ever before in the Roth account grow unimpeded by taxes.

Reasons not to do a Roth conversion.

Managing RMDs via QCDs and Roth Conversions

Investors who are dedicated to charitable causes can reap significant tax benefits from their retirement accounts. Once investors reach age 70½, they have the opportunity to divert up to $100,000 of funds annually directly from their Traditional IRA into qualified charities - a process called a Qualified Charitable Distribution or QCD for short. This distribution not only satisfies part or all of an investor's Required Minimum Distributions (RMD), but also is exempt from gross income and may be more beneficial than other below-the-line deductions! By utilizing this tax efficient channel through traditional IRAs, investors can significantly reduce taxes while still giving back in meaningful ways. There is a balancing act between doing too much in conversions if you plan on giving charitable donations via QCDs in your 70’s and beyond.

When your estate gives to charitable organizations

If you plan to leave your assets to a charity, it may not be worthwhile to pay taxes upfront and opt for Roth conversions. Non-profit organizations enjoy special tax status from the IRS so the funds donated won't incur additional taxation - making pre-payment of taxes unnecessary! So if your heirs don’t include family and friends but are charitable organizations, then you better rethink your strategy. Only do a Roth conversion in this case if you plan on spending the money later and it makes financial sense.

When Your Beneficiary Will Be in a Lower Tax Bracket Than You

If your beneficiaries will be in a lower tax bracket than you, it may not make sense to do the conversions. When planning for the future, thinking about who will benefit from your IRA at death is vital. Consider whether choosing to convert or not should happen based on which account owner pays taxes - you or your beneficiary? A smart strategy can help maximize the long-term value of this inheritance by letting whoever has a lower marginal tax bracket cover any associated tax. Keep in mind that the new Secure Act requires your heirs to distribute the funds within a 10 year window. You need to weigh the tax impact on a shorter time horizon as well.

Roth Conversions Can Tie Up Funds For 5 Years

For anyone under the age of 59 ½ a five year clock starts on January 1 of the year you did the conversion. If you take a distribution from the Roth in this 5 year window you are assessed a 10% penalty. Furthermore, if you are over the age of 59, you still have to wait 5 years from the time you first opened a Roth IRA to take distributions. If you have multiple Roth IRAs opened the clock starts with the first one you opened.

Can Effect Your Medicare Premiums

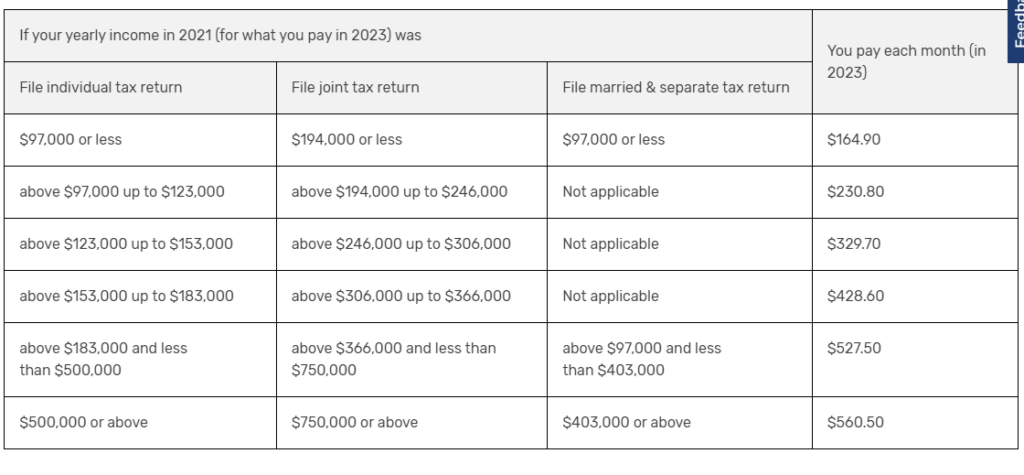

If you convert IRA funds to Roths it increases your income potentially impacting your Medicare premiums. Roth conversions can have a significant impact on your Medicare premiums. If you exceed the 2021 MAGI thresholds of $97,000 for individuals or $194,000 if married filing jointly two years out from conversion date, be prepared to see an increase in healthcare costs! Be careful here and if you can manage it, stay under the thresholds. If your income is higher than 194,000 filing a joint return you could pay roughly 1200 to 4800 in premiums per year just on Part B. See below.

Source: Medicare.gov

Conclusion

Benefits of a Roth conversion include tax free growth throughout retirement, no annual required minimum distributions (RMDs), and increased access to funds throughout retirement if necessary. Furthermore, with unsteady markets and potential losses, it’s smart to move more money in down markets. Then as your asset values recover, you can move more money into a tax-free account. Once you understand the advantages of a Roth conversion and how they can benefit you, both now and in the future, it is easy to make the decision to do one before taxes go up in 2026. But remember, converting to a Roth IRA is an irreversible event. You should look at the decision from all angles before you convert. It would be wise to consult a competent advisor before making the decision.

Sean West, Wealth Management Advisor/ CFP®

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.

Resources

IRS: https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2023