Each of us take different paths to arrive to where we are today. Some come from wealthy families never having needed to worry about finances. Others come from modest means, shaping how we view and preserve money. Or perhaps, you came into wealth suddenly through an inheritance or sale of a business.

No matter where your journey has taken you, putting a financial plan in place will allow you to weather any storms that may come. Meeting with White Cloud Wealth Management is an important first step to provide clarity and foresight along the path.

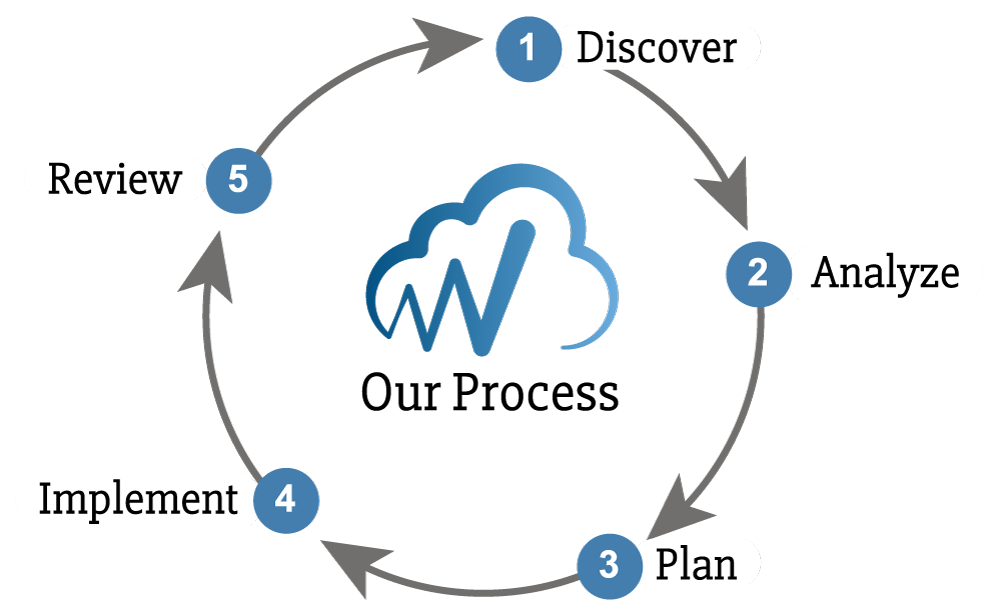

Our process for determining what you value and prioritize is outlined in the process below. Going through this process frequently helps us tailor a plan that will illuminate a clear path to reaching your financial goals.

We gather information both about your values and your financial circumstances. We identify your goals and priorities of where you are compared to where you want to be. We understand your whole picture before moving to the next step. We define our role in your plan and create an engagement.

With the information from our discovery we examine your possibilities. We look at the advantages and disadvantages of your current course of action; as well as look at your alternative paths and possibilities.

We develop and present planning recommendations. During this phase we select recommendations and strategies to accomplish your goals. We educate you on the financial science behind our process.

We help you decide which course of action is best. We implement the plan through follow up and division of responsibilities.

We review your plan quarterly, semiannual, or annually to make sure we are on track. We make adjustments as necessary.