At a Glance:

- Stocks slid into bear market territory after a bad May inflation report showed that prices rose at the fastest pace since 1981.1

- It's clear that the Federal Reserve's efforts to cool inflation haven't borne fruit yet, and investors are nervous.

Introduction

We knew that markets were going to continue their wild ride, and here we are. Stocks slid into bear market territory after a bad May inflation report showed that prices rose at the fastest pace since 1981.1 It's clear that the Federal Reserve's efforts to cool inflation haven't borne fruit yet, and investors are nervous. In response to these concerns about inflation, the Fed raised the benchmark interest rate by another 0.75 points, the most aggressive hike in nearly three decades.2 Their move will hopefully yield relief from rising prices but also means the cost of borrowing will go up, which could dent business and consumer spending.

Should I Be Worried About Markets?

Cautious, yes. Wary, perhaps. Afraid or worried? No. Here’s why:

- Many of the stocks leading the fall were highflyers during the pandemic, so the pullback could be a healthy correction of overblown prices.3

- Bear markets don't last forever. On average, they tend to linger for roughly 15 months. However, the 2020 bear market only lasted 33 days.4

- Half of the market's best days have happened during a bear market, so I expect some good days ahead.5

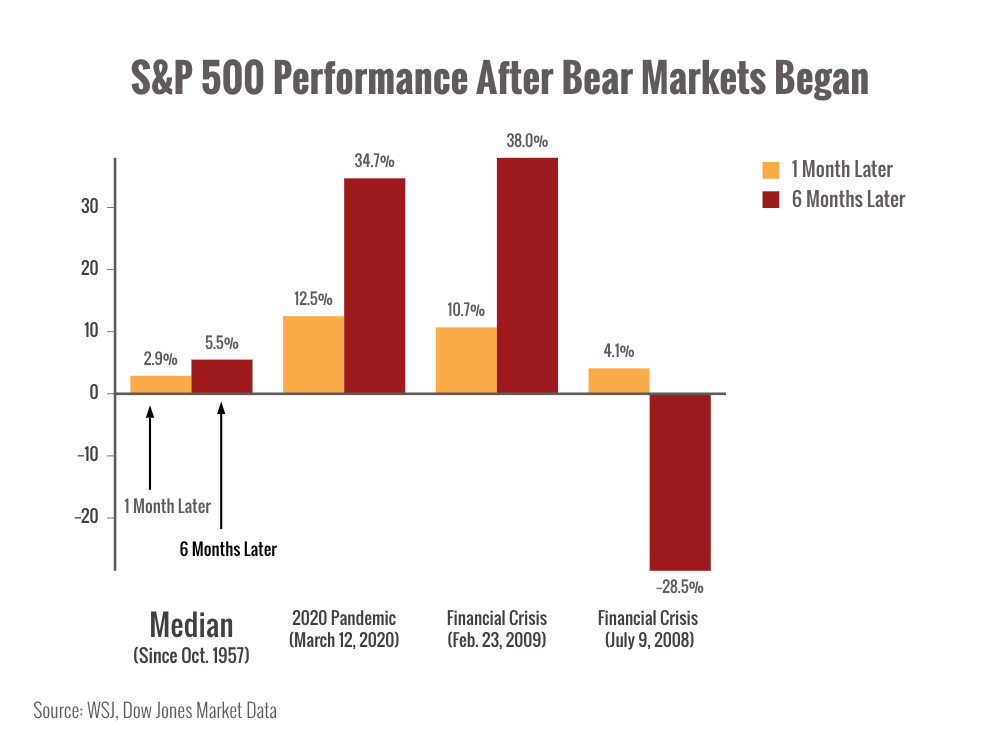

To give you some historical perspective here’s what happened during the last few bear markets:

You can see that in a couple of cases, markets bounced back within months. However, the 2008 bear market was a sustained pullback that lasted much longer. We believe the coming months will be more along the lines of the 2008 recession. Is history always an accurate predictor of the future? Definitely not. But we can look to it for hints about what may come.

What Happens Next?

Markets will likely continue to be extremely volatile over the next weeks and months as investors digest the Fed's aggressive rate hikes as well as concerns about an economic slowdown.

What Should I Do Now?

Great question, I'm so glad you asked. First of all, don't panic. We've been expecting wild market behavior and we've prepared for it. Market downturns can also create opportunities for selective bargain hunting if we stay flexible. We expect the market to continue to fall and as things turn around, we will take full advantage of these buying opportunities.

Bottom Line: Markets Like These Are Natural and Expected.

I'm here, I'm watching markets, and I'll reach out with specific recommendations as I have them. If you have any questions or concerns regarding your personal situation, feel free to call or email me.

P.S. Need a break from the markets? Watch jellyfish float at the Monterey Bay Aquarium.

Sean West, Wealth Management Advisor/ CFP®

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.