Table of Contents

Introduction

Hey, future retirees! Are you feeling a bit nervous about actually using those hard-earned savings? We know it can be stressful, but guess what? With the right retirement withdrawal strategy, you can make that money last longer than you ever thought possible. It's all about learning how to tap into your assets in the right order. Trust us, it makes a huge difference. Let's get started!

What Retirement Withdrawal Strategies Should I Consider? 3 Tax Saving Options

The 4% Rule

The trinity study was performed in 1998 and has shaped the way a lot of financial planners advise their clients to withdraw money in retirement. One of the key takeaways from the study was that you are fairly safe withdrawing 4% from your retirement accounts and not running out of money. Hence the 4% rule. As time goes along your withdrawals increase with inflation and with the values of your accounts.

The Income Bucket Retirement Withdrawal Strategy

With this retirement withdrawal strategy it’s smart to keep 1 years worth of expenses in CD’s, money markets, or T-bills. Then you keep another couple of years worth of expenses in short term treasury notes or municipal bonds depending on the type of account you are using. The income bucket strategy protects you from having to sell equity assets (real estate or stocks) when they are down in value. As time goes along you replenish your buckets during the good years.

Dynamic Retirement Withdrawal Strategy

In a perfect world you will design a strategy to withdraw more money while you are in your earlier years in retirement. This is when you have more energy to go do things on your bucket list. Therefore, wouldn’t it be nice to have a strategy that incorporates that fact? Dynamic withdrawal strategies’ aim is to reduce risk in down markets by reducing the amount of money withdrawn from the account in down years. It also aims to put in rules to follow to protect your nest egg in certain circumstances.

Dynamic withdrawal strategies can be complicated and specialized to each client, therefore it is probably not prudent to try to explain it in this article. Dynamic withdrawal strategies try to incorporate markets returns with the income needs of the retiree. If you would like to talk about how you can utilize a dynamic withdrawal strategy contact us here.

What Type of Accounts Should I Distribute First in Retirement?

You've got options to increase your after-tax income. But wait, don't go grabbing from just any account. It's a bit complicated, but we can help you figure it out. Timing is key to reduce your taxes in retirement, you'll need to withdraw strategically from your 401(k)s, Roth accounts, and other accounts. The right moves can make a big difference.

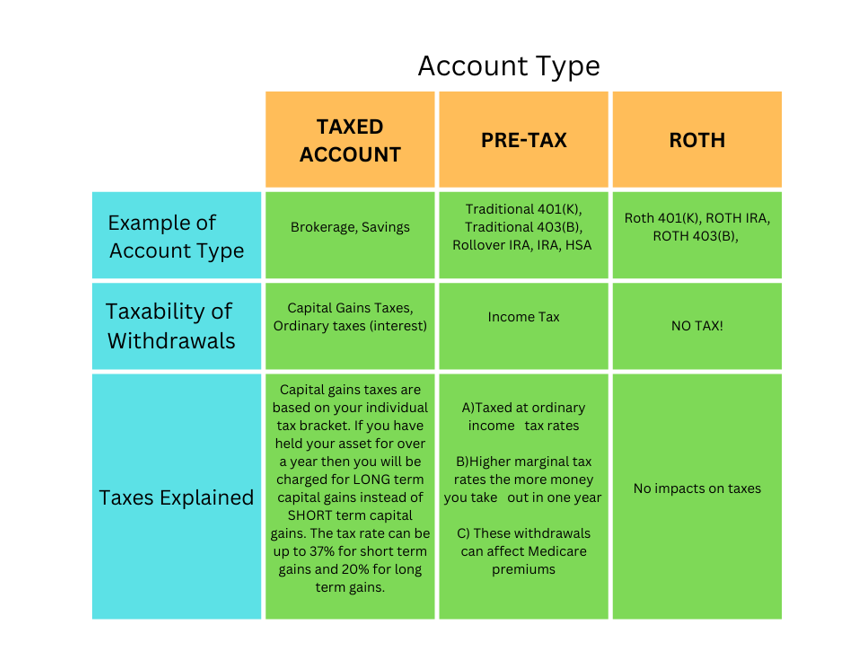

What Types of Investment Accounts are There?

Taxed Account

Also known as a brokerage account. In a taxed portfolio, there are no unique tax benefits. This means that the funds you invest with have already been taxed, and you will be taxed again when gains are triggered in the account via selling trades. In addition, these portfolios can create interest and dividends that are taxed on a yearly basis. Clarifying these tax implications can help you make informed decisions about your investment strategy. When you die these accounts usually get a step up in basis and transfer to your heirs’ tax free. Not a bad ending.

Pre-Tax Account

These are Traditional IRAs, 401ks, 403Bs, and 457 plans the list goes on. Investing in a pretax portfolio like a 401(k) or IRA allows you to contribute untaxed income towards your retirement savings. Your contributions are fully deductible from your taxes in the year you make them. The contributions and future profits earned in the pre-tax account are subject to taxes when withdrawn during retirement.

You are deferring taxes to the future, not bad eh? Because you got the tax benefit as you contributed to this over the years, you will pay taxes later in retirement (hopefully at a lower rate). Your heirs will inherit this tax deferred account and pay taxes on the entire amount over a 1 to 10 year time frame.

Post-Tax Account

These are accounts like Roth IRAs or Roth 401ks, post tax portfolios are the best! With this investment strategy, your contributions are made with fully taxed money, and are not tax deductible. However, the best part is that they grow tax deferred like an IRA. In the end you are able to pull distributions out tax free and your heirs withdraw the ROTH money out tax free as well. Everyone wins in the end with a ROTH.

Which Retirement Withdrawal Strategy Is Best?

There are no hard and fast rules to follow, but I advise that you spend your assets wisely to maximize the collective benefits that you, your heirs, and charities can receive. When dividing your assets among your heirs and preferred charities, it is crucial to consider the tax implications you may face during your lifetime, as well as the proportionate sizes of each account and the respective amounts intended for your beneficiaries and charities.

To achieve this objective, be mindful of the tax implications and prioritize spending that minimizes your tax liabilities. Anything that poses excessively high tax burdens could be directed towards your preferred charitable organizations. Here's a compilation of helpful pointers to help streamline your decision-making process.

For many years advisors have advocated for spending taxable assets first, then tax deferred, and finally tax-free assets. As simple as this sounds it may not always be the best option. So, it’s important to consider all the variables in your particular plan.

Navigating the decumulation years can be challenging. Balancing the desire to spend more, leave an inheritance, and give to charity can create conflict. On top of that, declining mental capacity makes the process even more daunting. If you're struggling to find clarity, we as advisors can guide you toward a sound solution. Let us help you chart the course to financial security.

Conclusion

There are many options to consider when looking at retirement withdrawal strategies. The task can seem daunting and even a little nerve racking at times. It is important to seek guidance if you are unsure on the correct path for you. After all, it could cost you your retirement.

Resource

IRS:

https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs