Estate planning is essential for ensuring your assets are distributed according to your wishes. One of the most effective tools in estate planning is a trust. Trusts in estate planning allow you to pass on wealth, protect assets, and potentially reduce taxes. However, with so many types of trusts available—such as Medicaid Asset Protection Trusts (MAPTs), Charitable Remainder Trusts (CRUTs and CRATs), and Special Needs Trusts (SNTs)—choosing the right one for your financial goals can be overwhelming.

In this guide, we’ll explain everything you need to know about trusts in estate planning, including when and why they’re necessary, the most common types of trusts, and how to choose the best one for your needs.

Table of Contents

What is a Trust?

A trust is a legal arrangement in which a grantor (also called a trustor) transfers assets to a trustee. The trustee manages these assets on behalf of the beneficiaries based on the terms set by the grantor.

Key Benefits of Using a Trust in Estate Planning

- Avoids Probate: Assets in a trust can bypass the lengthy and costly probate process.

- Protects Assets: Certain trusts shield assets from creditors, lawsuits, or Medicaid spend-down rules.

- Minimizes Estate Taxes: Many trusts help reduce estate taxes, preserving wealth for heirs.

- Ensures Specific Distribution of Assets: Trusts allow control over when and how beneficiaries receive inheritances.

- Supports Charitable Giving: Some trusts help donors support charities while benefiting from tax advantages.

When and Why Should You Use a Trust?

Trusts are used in estate planning for various reasons. Here are some of the most common situations where setting up a trust can be beneficial:

1. Asset Protection

Certain trusts shield assets from creditors, lawsuits, and divorce settlements, ensuring they remain intact for beneficiaries.

2. Avoiding Probate

Since trusts do not go through probate, beneficiaries receive their inheritance faster, with fewer legal fees and court processes.

3. Reducing Estate Taxes

Some trusts, such as Irrevocable Life Insurance Trusts (ILITs), remove assets from your taxable estate, lowering the potential tax burden.

4. Long-Term Care & Medicaid Planning

Medicaid Asset Protection Trusts (MAPTs) protect assets while allowing individuals to qualify for Medicaid, ensuring they receive long-term care benefits without losing their savings.

5. Supporting Family & Charitable Causes

Trusts allow you to provide for loved ones, dependents with special needs, and charitable organizations, often with added tax advantages.

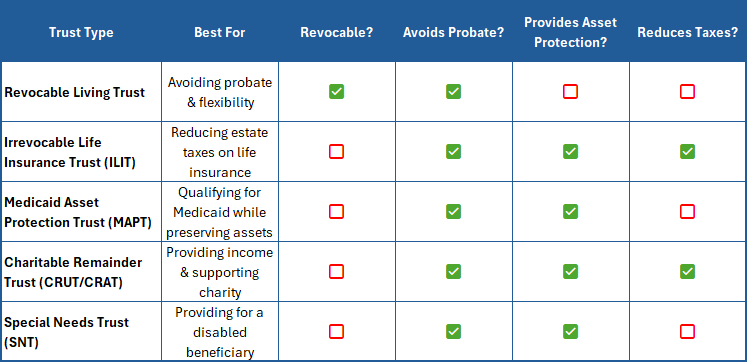

Types of Trusts in Estate Planning

There are many types of trusts, each serving a different purpose. Here’s a breakdown of the most commonly used trusts in estate planning.

1. Revocable Living Trust

Purpose: Avoids probate and provides flexibility in managing assets.

Who Should Consider It: Anyone looking for a straightforward way to transfer assets efficiently.

How It Works: The grantor retains control and can modify or revoke the trust during their lifetime. Upon their death, assets transfer directly to beneficiaries without probate.

Pros:

- Avoids probate for faster asset distribution.

- Flexible—can be changed during the grantor’s lifetime.

Cons:

- No asset protection from creditors.

- Still included in taxable estate. Keep in mind that your estate may not be over the estate tax exemption and therefore not taxable.

Example: Avoiding Probate for Future Generations

Siblings Mark and Lisa went through a long and frustrating probate process after their parents passed away. The court proceedings took over a year, costing thousands in legal fees and delaying access to their inheritance. After this experience, they knew they didn’t want their own children to face the same ordeal.

With the help of an estate planning attorney, they set up a revocable living trust for each of their families. This ensured that their assets— including their family home and savings—would be transferred directly to their children upon their passing without probate. Now, Mark and Lisa have peace of mind knowing their kids will avoid unnecessary legal delays and receive their inheritance smoothly.

2. Medicaid Asset Protection Trust (MAPT)

Purpose: Helps individuals qualify for Medicaid while protecting their assets.

Who Should Consider It: Those planning for long-term care who want to safeguard their wealth from Medicaid spend-down requirements.

How It Works: Assets placed in an MAPT are not counted as part of your estate for Medicaid eligibility. However, this trust must be established at least five years before applying for Medicaid to be effective.

Pros:

- Protects assets for heirs.

- Helps individuals qualify for Medicaid.

Cons:

- Must be created well in advance.

- Restricts access to assets.

Example: Qualifying for Medicaid Without Losing Assets

Margaret, a 72-year-old widow, was worried about the high costs of long-term care. She had savings, a home, and investments that she wanted to pass on to her children but feared she would have to spend them down to qualify for Medicaid.

With an attorney’s guidance, she set up a Medicaid Asset Protection Trust (MAPT) and transferred her assets into it. Because she did this five years before needing care, her assets were protected from Medicaid’s spend-down requirements. When Margaret entered a nursing home, Medicaid covered her expenses, and her children still inherited her home and savings.

3. Irrevocable Life Insurance Trust (ILIT)

Purpose: Reduces estate taxes by keeping life insurance proceeds out of the estate.

Who Should Consider It: Those with large life insurance policies looking to lower estate taxes.

How It Works: The ILIT owns the life insurance policy, and upon the grantor’s passing, the death benefit goes directly to beneficiaries tax-free.

Pros:

- Removes life insurance proceeds from estate taxation.

- Protects insurance proceeds from creditors.

Cons:

- Irrevocable—once created, it cannot be changed.

- Requires giving up control of the policy.

Example: Reducing Estate Taxes with an ILIT

James and Rebecca had a $2 million life insurance policy, but they discovered that the policy’s payout would be included in their taxable estate, significantly increasing the estate taxes their children would owe.

To prevent this, they established an Irrevocable Life Insurance Trust (ILIT) and transferred ownership of the policy to the trust. When James passed away, the insurance payout went directly to their children, tax-free, saving them hundreds of thousands of dollars in estate taxes.

4. Charitable Remainder Trusts (CRAT & CRUT)

Purpose: Provides income to beneficiaries while donating the remaining assets to charity.

Who Should Consider It: Those looking to support a charity while benefiting from tax savings.

How It Works:

Charitable Remainder Annuity Trust (CRAT): Provides a fixed annual income.

Charitable Remainder Unitrust (CRUT): Pays a percentage of trust assets, recalculated annually.

Pros:

- Provides income while supporting a charitable cause.

- Tax benefits for donors.

Cons:

- Irrevocable—cannot be modified once established.

- CRAT payments are fixed, while CRUT payments fluctuate with market performance.

CRAT Example: Creating Retirement Income & Supporting a Charity

David, a retired business owner, wanted to support his favorite charity but also needed a steady income stream. Instead of donating a lump sum, he set up a Charitable Remainder Annuity Trust (CRAT).

David funded the trust with $500,000, and in return, he received a fixed annual income for the rest of his life. After he passed away, the remaining funds went to the charity of his choice. This arrangement lowered his taxable income, provided him with financial security, and left a legacy for a cause he cared about.

CRUT Example: Flexible Income & Charitable Giving

Susan, a 60-year-old investor, wanted to donate to charity while ensuring her retirement income kept up with inflation. Instead of a CRAT, she opted for a Charitable Remainder Unitrust (CRUT).

Unlike a CRAT, which provides fixed payments, her CRUT paid her a percentage of the trust’s assets, which was recalculated annually. As the investments grew, so did her income. After she passed away, the remaining assets went to her designated charity. This gave her a steady, increasing income while fulfilling her philanthropic goals.

5. Qualified Personal Residence Trust (QPRT)

Purpose: Reduces estate taxes by gifting a home at a lower tax value.

Who Should Consider It: Homeowners who want to pass property to heirs while minimizing estate taxes.

How It Works: The grantor retains the right to live in the home for a set period, after which ownership transfers to the beneficiaries.

Pros:

- Reduces estate taxes.

- Allows grantor to stay in the home for a set term.

Cons:

- Irrevocable—the home transfers at the end of the trust term.

- Beneficiaries may owe taxes if they sell the home.

Example: Passing Down a Family Home Without Estate Taxes

Tom and Linda owned a vacation home valued at $1 million. They wanted to pass it down to their children but worried about estate taxes.

To minimize taxes, they transferred the home into a Qualified Personal Residence Trust (QPRT), allowing them to continue living in it for 15 years. Since the home’s value at the time of transfer was lower than its future value, it reduced the taxable estate amount.

When the trust’s term ended, ownership of the home passed to their children at a lower tax rate, saving the family hundreds of thousands of dollars.

6. Special Needs Trust (SNT)

Purpose: Provides financial support for a disabled beneficiary without affecting their government benefits.

Who Should Consider It: Families with dependents who receive Medicaid or Supplemental Security Income (SSI).

How It Works: Assets are held in the trust and used for the beneficiary’s expenses without disqualifying them from benefits.

Pros:

- Preserves eligibility for government programs.

- Ensures ongoing financial support for a disabled beneficiary.

Cons:

- Funds must be used only for approved expenses to maintain benefits.

- Requires careful management.

Example: Protecting Government Benefits for a Child with Disabilities

Emma and Daniel had a son, Josh, who was born with special needs. They worried that if he inherited assets outright, he would lose eligibility for Medicaid and Supplemental Security Income (SSI).

To ensure he had long-term financial security without jeopardizing his benefits, they set up a Special Needs Trust (SNT). This trust paid for Josh’s extra care, education, and recreational activities while preserving his government assistance.

When Emma and Daniel passed away, the trust continued supporting Josh’s needs, ensuring he remained financially secure.

Frequently Asked Questions (FAQs) About Trusts in Estate Planning

1. What is the main advantage of a trust over a will?

A trust avoids probate, ensuring a faster and more private asset transfer, while a will must go through the court process.

2. Can a trust help reduce estate taxes?

Yes, certain trusts, such as ILITs, CRATs, and QPRTs, help reduce estate taxes by removing assets from the taxable estate.

3. How long does it take to set up a trust?

Setting up a trust typically takes a few weeks to a few months, depending on complexity.

4. Can I change my trust after it’s created?

- Revocable trusts can be changed anytime.

- Irrevocable trusts cannot be modified once established.

5. Do trusts work in all states?

Yes, but state laws vary, so consulting an estate planning attorney is recommended.

Final Thoughts

Trusts are powerful tools in estate planning, offering benefits such as avoiding probate, protecting assets, and reducing taxes. Selecting the right trust depends on your financial goals and family situation. Working with an estate planning attorney ensures your trust aligns with your long-term wishes.

Ready to protect your assets? Start planning today with White Cloud Wealth Management to find the right trust for your estate! As fiduciaries, we prioritize your best interests, offering comprehensive financial planning designed to inspire confidence in your financial future. We can help analyze your unique situation and help you to protect your assets and your legacy.

Whether you prefer an in-person meeting or a remote consultation, we’d be delighted to discuss your goals and answer any questions you have.

Click to schedule your personalized consultation.

By Jacob Nye, Wealth Management Advisor

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.