Social Security survivors benefits provide crucial financial support to widows, widowers, and other eligible family members of a deceased worker. Understanding how these benefits work and when to claim them can significantly impact your long-term financial security. In this guide, we’ll break down eligibility rules, payment amounts, and key strategies to maximize your benefits.

Table of Contents

What Are Social Security Survivors Benefits?

Survivors benefits are monthly payments provided by the Social Security Administration (SSA) to qualifying family members of a deceased worker who earned enough credits through their work history. The amount you receive depends on the worker’s lifetime earnings and the age at which you claim benefits.

Who Is Eligible for Survivors Benefits?

The following individuals may qualify for Social Security survivors benefits:

- Spouses (including divorced spouses if married for at least 10 years)

- Children (under age 18, up to 19 if still in high school, or disabled before age 22)

- Dependent parents (age 62 or older)

When Can I Claim Social Security Survivors Benefits?

The age at which you claim survivors benefits affects the amount you receive:

- Earliest age: Age 60 (or 50 if disabled) with reduced benefits.

- Full benefits: At your Full Retirement Age (FRA) (between 66 and 67, depending on birth year).

- Any age if caring for a child under 16 or a disabled child of the deceased worker.

How Much Will I Receive In Social Security Survivors Benefits?

For a Surviving Spouse:

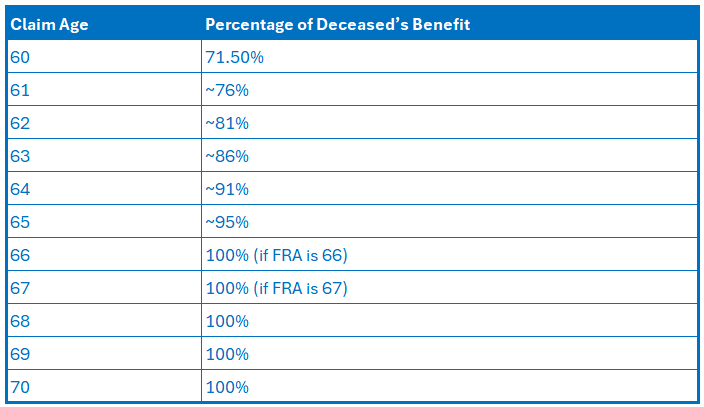

Timing can make a big difference when claiming social security survivors benefits. Note that delaying past full retirement age (FRA) does not increase your survivors benefit. To find out when your FRA is, create an account or log in on the social security website.

For a Surviving Child:

- 75% of the deceased worker’s benefit, if the child is under 18 or up to 19 if still in high school

- 75% of the deceased worker's benefit for disabled children who can receive the benefit until they are no longer disabled. This child can receive the benefits as an adult but must be classified as disabled prior to age 22.

- Stepchildren, adopted children, and dependent grandchildren may also qualify in certain cases.

- To apply, a child’s guardian must provide the deceased parent’s Social Security number, birth certificate, and proof of relationship.

For Dependent Parents:

- 82.5% for one surviving dependent parent (age 62 or older).

- 75% each if two dependent parents qualify.

- Note that this option may not make sense of the dependent parent has a higher social security amount than the survivors benefits.

Family Maximum Limit:

Social Security caps the total payout to 150% - 180% of the deceased worker’s full benefit amount for a given family. If multiple survivors—such as a spouse, children, or dependent parents—qualify for benefits, the total must stay within this limit.

When benefits exceed the cap, each person's payment is proportionally reduced, except for the surviving spouse who has reached full retirement age (FRA). Understanding this limit is crucial for families with multiple beneficiaries, as it affects how much each person receives. If you’re in this situation, speaking with a Social Security representative or a financial advisor can help you plan your claims effectively.

Smart Strategies for Claiming Social Security Survivors Benefits

1. Use the Survivor Benefit to Delay Your Own Retirement Benefit

If your own Social Security retirement benefit will be higher than your survivors benefit, a smart strategy is to claim survivors benefits first and delay your retirement benefit until age 70. This allows your personal benefit to grow due to delayed retirement credits, increasing your monthly payments.

Example:

- At age 60, Lisa’s survivors benefit is $1,500 per month.

- If she waits until age 70, her own retirement benefit will grow to $2,300 per month.

- Lisa can take the survivors benefit first and switch to her own benefit at 70 for higher lifetime payments.

2. Claim Your Own Benefit First and Switch to Survivors Benefits Later

If your survivors benefit is larger than your own retirement benefit, you might claim your own reduced retirement benefit first and switch to the larger survivors benefit at FRA for full payments.

Example:

- Mark qualifies for $1,200 per month from his own Social Security at 62.

- His survivors benefit at FRA is $2,000 per month.

- He claims his own reduced benefit at 62 and switches to the full survivors benefit at FRA, maximizing his income over time.

3. Reduced Social Security Survivors Benefits if Still Working

If you claim survivors benefits before your FRA and continue working, your benefits may be reduced if your earnings exceed the annual limit ($21,240 in 2025). Survivor benefits are reduced by $1 for every $2 that your income exceeds the limit. With a high enough income, the reduction could wipe out the benefit amount. If you’re working, delaying benefits may be a better option to avoid reductions.

4. Be Strategic About Remarriage

- If you remarry before age 60, you lose eligibility for survivors benefits.

- If you remarry after age 60, you keep eligibility for survivors benefits.

Taxes on Social Security Survivors Benefits

Social Security survivors benefits may be taxable depending on your total income. If your combined income (including Social Security, wages, and other retirement income) exceeds $25,000 for individuals or $32,000 for married couples filing jointly, a portion of your benefits may be subject to federal taxes. To minimize taxes, consider spreading withdrawals across multiple retirement accounts or delaying benefits until needed. Click here to see best retirement withdrawal strategies.

In addition to federal taxes, there are also 9 states that tax social security benefits. Those states are Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont and West Virginia. If you retire in any of the 41 other states, then your benefits will be state tax free.

Frequently Asked Questions (FAQ)

How can I know if my spouse left me social security survivors benefits?

To qualify for Social Security survivors benefits, the deceased spouse must have worked and earned enough Social Security credits based on their age at death. Generally, a worker needs at least 40 credits (10 years of work) to be fully insured, but younger workers may qualify with fewer credits. To confirm eligibility, contact Social Security at 1-800-772-1213 or visit your local SSA office.

Can a surviving spouse receive the full social security disability amount?

Disabled individuals can be eligible to receive their full retirement age benefit early, regardless of the age at which the disability began. This means that even if the deceased spouse became disabled at 63, they were receiving what they would have received at full retirement age. In the event of their death, the surviving spouse can receive the full social security disability amount as a survivor benefit—but only if they are at or past their own full retirement age when they begin collecting. If the surviving spouse claims survivor benefits early (as early as age 60), the monthly amount is reduced. However, if the surviving spouse waits until full retirement age or later (like age 72 in this example), they will receive the full benefit amount the deceased was receiving.

Can I receive survivors benefits if I was not married but lived with the deceased?

No, Social Security does not provide survivors benefits for unmarried partners, even if they lived together for many years. Only legal spouses, dependent children, and in some cases, dependent parents qualify.

Can I collect both my own and my spouse’s Social Security benefits?

No, you cannot receive both benefits in full. If you qualify for both, Social Security pays the higher of the two amounts, not both combined.

How does receiving a pension affect survivors benefits?

If you receive a pension from work not covered by Social Security (such as a government or foreign pension), your survivors benefits may be reduced due to the Government Pension Offset (GPO) rule. Check with Social Security to see how your specific pension affects your benefits.

Do survivors benefits increase if I delay taking them?

Survivors benefits do not increase beyond Full Retirement Age (FRA). Unlike personal retirement benefits, which grow if delayed to age 70, survivors benefits max out at FRA.

How to Apply for Survivors Benefits: Step-by-Step Guide

- Gather Required Documents: Birth certificate, marriage certificate, death certificate, and Social Security numbers.

- Contact Social Security: Call 1-800-772-1213 or visit a local office.

- Complete the Application: Submit necessary paperwork and verify details. See survivors benefits application here.

- Wait for Approval: The SSA typically processes applications within a few weeks.

Recap: 7 Mistakes to Avoid When Claiming Your Survivors Benefits

Many people miss out on thousands of dollars in Social Security survivors benefits due to avoidable mistakes. Here are some key pitfalls to watch out for:

- Claiming Benefits Too Early – If you claim before full retirement age (FRA), your benefit will be permanently reduced. It may be better to delay if you have other income sources.

- Not Switching to a Higher Benefit Later – If your own Social Security retirement benefit will be higher than your survivors benefit at age 70, you may want to claim survivors benefits first and switch later to maximize your payout.

- Ignoring the Earnings Limit – If you claim before FRA and are still working, Social Security may reduce or withhold your benefits if you earn more than the annual limit ($21,240 in 2025).

- Remarrying Too Early – If you remarry before age 60 (or before 50 if disabled), you lose eligibility for survivors benefits. Waiting until after age 60 allows you to keep receiving them.

- Failing to Claim for Eligible Children – Many widowed parents don’t realize that children under 18 (or 19 if in high school) and disabled adult children may qualify for up to 75% of the deceased parent’s benefit.

- Not Understanding Family Maximum Limits – If multiple family members qualify, their benefits may be reduced due to the 150%-180% family cap, so planning ahead is crucial.

- Delaying Too Long to Apply – Survivors benefits are not automatic, so you must apply. You can claim retroactively for up to six months, but waiting too long could mean missing out on potential income.

By avoiding these common mistakes and strategically planning your claim, you can maximize your survivors benefits and ensure greater financial security.

Final Thoughts: Choosing the Right Claiming Strategy

Deciding when to claim Social Security survivors benefits is not one-size-fits-all. The best strategy depends on your personal benefit amounts, age, and financial situation. By using survivors benefits strategically, you can maximize your total lifetime Social Security income and secure a stronger financial future.

Would you like help calculating your potential survivors benefits or exploring the best claiming strategy? White Cloud Wealth Management is here to help. As fiduciaries, we prioritize your best interests, offering comprehensive financial planning designed to inspire confidence in your financial future. We can help analyze your unique situation and help you to maximize your social security survivors benefits.

Whether you prefer an in-person meeting or a remote consultation, we’d be delighted to discuss your goals and answer any questions you have.

Click to schedule your personalized consultation.

By Jacob Nye, Wealth Management Advisor

Disclosure

This blog reflects the personal opinions, viewpoints and analyses of the White Cloud Wealth Management employees providing such comments, and should not be regarded as a description of advisory services provided by White Cloud Wealth Management. The views reflected in the blog are subject to change at any time without notice. Nothing in this material constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security.